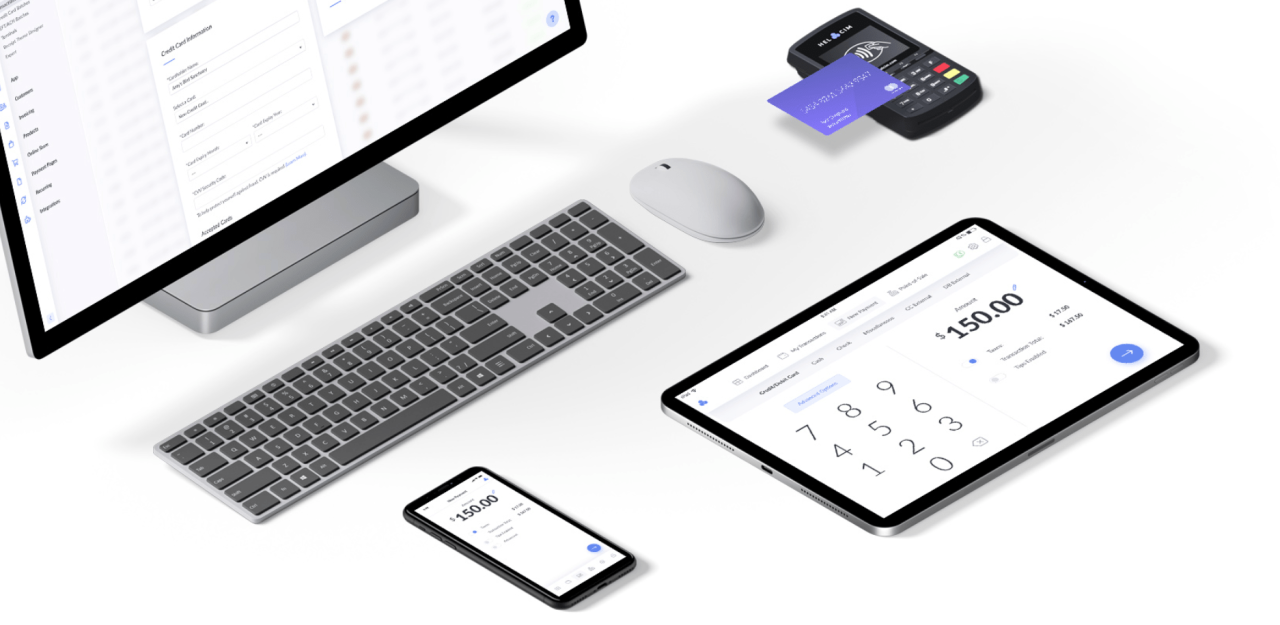

In today’s fast-paced world, businesses need to be where their customers are, and often, that’s on the go. Imagine the freedom of closing sales at a craft fair, delivering services at a client’s location, or simply offering a more convenient payment option. This guide unlocks the potential of mobile credit card processing, transforming your smartphone or tablet into a powerful payment solution.

From understanding the benefits of accepting payments on the move to navigating the latest security measures, we’ll cover everything you need to know. We’ll delve into choosing the right payment processor, setting up your system, and mastering the step-by-step procedures. Get ready to embrace the convenience, boost your sales, and elevate your customer experience with the power of mobile payments.

Understanding the Need for Mobile Credit Card Processing

/GettyImages-500500849-56a066c43df78cafdaa16b4d.jpg)

Mobile credit card processing has revolutionized how businesses of all sizes operate. This shift has created new opportunities for growth and increased customer satisfaction. Understanding the need for mobile payment solutions is crucial for any business looking to thrive in today’s market.

Benefits for Small Businesses

Accepting credit card payments on the go offers several advantages that can significantly benefit small businesses. These benefits extend beyond just convenience, impacting sales and overall operational efficiency.

- Increased Sales: Mobile payments allow businesses to accept payments anywhere, anytime. This removes the barrier of limited payment options, potentially leading to more sales. For example, a food truck can cater to more customers during peak hours by quickly processing card payments.

- Improved Customer Experience: Customers appreciate the convenience of paying with their preferred method. Mobile payments streamline the transaction process, making it faster and more efficient, enhancing the overall customer experience.

- Reduced Risk of Missed Sales: Without mobile payment options, businesses risk losing sales from customers who don’t carry cash or prefer card payments. Mobile processing eliminates this risk.

- Professionalism and Credibility: Offering mobile payment options projects a professional image and signals to customers that the business is modern and customer-focused.

- Access to Data and Analytics: Mobile payment solutions often come with integrated reporting tools. This provides businesses with valuable insights into sales trends, customer behavior, and other important metrics.

Industries Relying on Mobile Payment Solutions

Several industries heavily depend on mobile payment solutions to conduct business efficiently and serve their customers effectively. These industries benefit from the ability to process payments in various locations and provide convenient payment options.

- Food Trucks and Catering: These businesses operate in locations where traditional point-of-sale systems are impractical. Mobile payment solutions allow them to accept payments quickly and efficiently.

- Tradespeople (Plumbers, Electricians, etc.): Service providers often need to collect payments on-site. Mobile processing simplifies the billing process and eliminates the need for invoicing.

- Market Vendors: Vendors at farmers’ markets, craft fairs, and other outdoor events can easily accept card payments, increasing sales potential.

- Delivery Services: Businesses that deliver goods or services, such as restaurants and courier services, benefit from the ability to process payments upon delivery.

- Mobile Salons and Spas: Professionals who offer services at clients’ homes or other locations can easily accept payments with mobile payment systems.

Impact on Customer Convenience and Sales

Mobile payments significantly impact customer convenience and, consequently, sales figures. By providing a seamless and flexible payment experience, businesses can attract and retain customers.

The convenience of mobile payments directly translates into increased sales. Customers are more likely to make a purchase when they have multiple payment options, especially if those options are quick and easy to use. For example, a study by Square found that businesses using their mobile payment system saw an average increase in sales of 25% compared to businesses that only accepted cash.

The flexibility of mobile payments also benefits customers. They can pay with their preferred method, regardless of location. This is particularly important for younger generations, who are increasingly reliant on digital payment methods.

Choosing the Right Mobile Payment Processor

Selecting the right mobile payment processor is crucial for your business’s financial health and operational efficiency. A well-chosen processor streamlines transactions, ensures security, and can even offer valuable features to help you manage your business more effectively. Conversely, a poor choice can lead to hidden fees, security vulnerabilities, and a frustrating experience for both you and your customers. This section will guide you through the key factors to consider and compare some of the most popular options available.

Key Factors for Selecting a Mobile Payment Processor

When choosing a mobile payment processor, several key factors should influence your decision. Understanding these elements will help you select the best solution for your specific business needs.

- Fees: Payment processors charge fees for their services. These fees can vary significantly and typically include transaction fees (a percentage of each sale plus a per-transaction fee), monthly fees, and sometimes other charges, such as chargeback fees. Understanding the fee structure is crucial for predicting your processing costs.

- Example: A processor might charge 2.9% + $0.30 per transaction.

This means for a $100 sale, you’d pay $3.20 in fees.

- Example: A processor might charge 2.9% + $0.30 per transaction.

- Security: Data security is paramount. Your chosen processor must adhere to Payment Card Industry Data Security Standard (PCI DSS) compliance to protect sensitive cardholder data. Look for features like end-to-end encryption and tokenization to minimize the risk of data breaches.

- Compatibility: Ensure the processor is compatible with your existing hardware and software. This includes your mobile device (iOS or Android), any point-of-sale (POS) systems you use, and any accounting or inventory management software.

- Features: Consider the features offered by each processor. Some offer basic payment processing, while others provide advanced functionalities like inventory management, customer relationship management (CRM) tools, and reporting dashboards.

- Customer Support: Evaluate the availability and quality of customer support. You’ll need reliable support in case of technical issues or payment disputes. Look for processors that offer phone, email, and live chat support.

- Hardware: Some processors require specific hardware, such as card readers. Consider the cost and ease of use of this hardware. Some offer free card readers, while others charge a fee.

- Payout Schedule: Understand how frequently you’ll receive payouts. Some processors offer daily or next-day payouts, while others have longer payout cycles. This can impact your cash flow.

Comparison of Popular Mobile Payment Processors

Choosing a mobile payment processor involves weighing the pros and cons of various options. Here’s a comparison of some of the most popular processors, highlighting their key features:

| Processor | Transaction Fees | Key Features | Hardware |

|---|---|---|---|

| Square | 2.6% + $0.10 per transaction (in-person); 2.9% + $0.30 (online) | Free POS app, inventory management, customer directory, reporting, Square Online Store, integrates with many apps. | Free card reader for magstripe cards; Chip and tap reader available. Additional hardware like a stand for iPad. |

| PayPal Here | 2.69% per transaction (in-person); 3.49% + $0.49 (online) | Accepts PayPal payments, invoicing, reporting, integrates with PayPal Business account, payment links. | Card reader available for purchase. |

| Stripe | 2.9% + $0.30 per successful card charge (in-person and online) | Developer-friendly, customizable payment flows, global payments, supports recurring billing, detailed reporting. | Integrates with third-party card readers. |

| Clover Go | Varies depending on the plan (from 2.6% + $0.10) | Inventory management, customer management, loyalty programs, reporting, integrates with Clover POS systems. | Card reader included with some plans. |

PCI Compliance and Data Security in Mobile Payment Processing

PCI compliance and data security are non-negotiable aspects of mobile payment processing. Failing to comply with these standards can result in hefty fines, damage to your business’s reputation, and legal ramifications.

- PCI DSS Compliance: The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. This involves regular security audits, vulnerability scans, and adherence to specific security protocols.

PCI DSS compliance is not optional; it is a requirement for any business accepting credit card payments.

- Data Encryption: Encryption transforms sensitive data into an unreadable format, protecting it from unauthorized access. Mobile payment processors should use end-to-end encryption to secure cardholder data from the moment the card is swiped or tapped until the transaction is processed.

- Tokenization: Tokenization replaces sensitive cardholder data with a unique, non-sensitive “token.” This token is then used for processing transactions, reducing the risk of data breaches.

- Secure Hardware: The card reader itself should be designed with security in mind. This includes features like tamper-resistant hardware and secure firmware updates.

- Regular Security Audits: Mobile payment processors should undergo regular security audits to identify and address any vulnerabilities. These audits help ensure that the processor’s systems are secure and compliant with PCI DSS standards.

Setting Up Your Mobile Payment System

Getting your mobile payment system up and running is a straightforward process. This section breaks down the essential steps, guiding you through account creation, app installation, and hardware setup. Following these instructions will enable you to accept credit card payments seamlessly on the go.

Creating an Account with a Mobile Payment Processor

The first step is to establish an account with your chosen mobile payment processor. This involves providing specific information to verify your identity and business.Here’s a typical account creation process:

- Visit the Processor’s Website or App: Navigate to the payment processor’s website or download their mobile application. This is usually the starting point for creating a new account.

- Sign Up: Locate the “Sign Up,” “Get Started,” or similar button. This will initiate the account creation process.

- Provide Business Information: You will be prompted to enter your business details. This typically includes:

- Business Name

- Business Type (e.g., sole proprietorship, LLC, corporation)

- Business Address

- Tax Identification Number (EIN or SSN)

- Provide Personal Information: You’ll need to provide personal details, such as:

- Your Full Name

- Date of Birth

- Home Address

- Phone Number

- Banking Information: You’ll be required to link a bank account where you want to receive your payments. This includes:

- Bank Name

- Account Number

- Routing Number

- Review and Accept Terms of Service: Carefully review the payment processor’s terms of service, including fees, processing times, and other relevant policies. Accept the terms to proceed.

- Verification: The payment processor will verify the information you provided. This may involve identity verification or business verification, which can sometimes take a few days. They might ask for a copy of your driver’s license or other documents.

- Account Activation: Once your information is verified, your account will be activated. You should receive a confirmation email or notification.

Downloading and Installing the Payment Processing App

Once your account is created, the next step involves installing the mobile app on your smartphone or tablet. This app is the interface you will use to process transactions.Here’s how to download and install the app:

- Locate the App: Open the app store on your mobile device (Google Play Store for Android devices or the App Store for iOS devices).

- Search for the App: Search for the name of your chosen payment processor’s app (e.g., “Square,” “PayPal Here,” “Stripe”).

- Download and Install: Tap the “Get” or “Install” button next to the app icon. The app will download and install on your device.

- Open the App: Once the installation is complete, tap the app icon to open it.

- Log In: Enter your account credentials (username and password) to log in to your account.

- Grant Permissions: The app may request permissions to access certain features of your device, such as the camera (for scanning card information), location services (for tracking transactions), and Bluetooth (for connecting to a card reader). Grant the necessary permissions.

- Test the App: After logging in, test the app by processing a small transaction. This confirms the app is working correctly.

Setting Up Hardware: Connecting a Card Reader

Connecting a card reader is essential for processing card-present transactions. The setup process varies depending on the type of card reader and the payment processor.Here’s a general guide to setting up a card reader:

- Choose Your Card Reader: The type of card reader you choose will affect the setup. Most payment processors offer several options, including:

- Bluetooth Card Readers: These connect wirelessly to your mobile device.

- Card Readers that plug into the audio jack: These are less common nowadays but can be used.

- Card Readers that connect via the Lightning or USB-C port: These are compatible with newer devices.

- Charge the Card Reader: Ensure your card reader is fully charged before you begin. This is particularly important for Bluetooth readers.

- Turn On the Card Reader: Power on the card reader. It usually has a power button.

- Pair the Card Reader (Bluetooth Readers): For Bluetooth card readers, you need to pair the reader with your mobile device:

- Open the payment processing app on your device.

- Go to the settings menu.

- Look for a section labeled “Card Readers,” “Hardware,” or “Devices.”

- Select the option to connect a card reader.

- Follow the on-screen instructions to pair the reader with your device. This typically involves selecting the card reader from a list of available devices.

- Connect the Card Reader (Other Readers): For card readers that plug into the audio jack or a charging port, simply plug the reader into the corresponding port on your mobile device.

- Test the Connection: Within the payment processing app, process a test transaction to ensure the card reader is functioning correctly. If the connection fails, check the following:

- Ensure the card reader is turned on and charged.

- Verify that Bluetooth is enabled on your mobile device (for Bluetooth readers).

- Make sure the card reader is compatible with your device and the payment processing app.

Hardware and Software Requirements

Setting up your mobile credit card processing system involves more than just choosing a payment processor; you also need the right tools. Understanding the hardware and software requirements is crucial for a smooth, secure, and efficient payment experience. This section Artikels the essential components you’ll need and provides guidance on troubleshooting common issues.

Hardware Essentials

To accept credit card payments on the go, you’ll need specific hardware to interact with your customers and process transactions. This includes devices to read cards and connect to the internet.

- Mobile Card Reader: This is the most crucial piece of hardware. It physically connects to your mobile device (smartphone or tablet) and reads the credit card information. There are two primary types:

- Card Readers that plug into the audio jack or Lightning/USB-C port: These readers are often compact and inexpensive. They’re suitable for businesses with lower transaction volumes.

- Bluetooth Card Readers: These readers connect wirelessly to your mobile device via Bluetooth. They tend to be more versatile, often supporting EMV chip cards, contactless payments (like NFC), and sometimes even magnetic stripe cards.

Make sure your card reader is compatible with the payment processor you’ve chosen.

- Mobile Device (Smartphone or Tablet): Your smartphone or tablet acts as the central hub for processing payments. It runs the payment processor’s software, connects to the internet, and communicates with the card reader. Choose a device that is reliable and has a decent battery life, as you will be relying on it throughout your business day.

- Internet Connection: A stable internet connection is vital for processing transactions. You can use:

- Wi-Fi: When available, Wi-Fi provides a reliable and cost-effective connection.

- Mobile Data (4G/5G): Ensure your mobile device has a data plan with sufficient bandwidth to handle payment processing. Be mindful of data usage, especially if you process a large number of transactions.

- Optional Hardware:

- Receipt Printer: Some businesses prefer to provide physical receipts. Portable Bluetooth receipt printers are available.

- Cash Drawer (for retail setups): If you handle cash transactions alongside card payments, a cash drawer can be integrated with your mobile POS system.

Software Requirements and Compatibility

The software you use is as important as the hardware. Your payment processor’s software determines how you interact with the system, how transactions are processed, and how data is managed.

- Payment Processor App: This is the core software. Download the payment processor’s app from your device’s app store (e.g., Google Play Store for Android or App Store for iOS). The app will guide you through setting up your account and connecting your card reader.

- Operating System Compatibility: Ensure your mobile device’s operating system (Android or iOS) is compatible with the payment processor’s software. Payment processors typically list the supported OS versions on their websites. For example, Square requires iOS 14 or later and Android 7.0 or later as of late 2023.

- Device Compatibility: Confirm that your mobile device model is compatible with the card reader and the payment processor’s app. Some older or less common devices might not be supported.

- Software Updates: Regularly update the payment processor app to ensure you have the latest features, security patches, and bug fixes. Enable automatic updates if possible.

- Integration with Other Software: Some payment processors integrate with other business software, such as accounting software (e.g., QuickBooks, Xero) or point-of-sale (POS) systems. This integration can streamline your business operations by automatically syncing transaction data. Check if your payment processor offers integrations with the software you use.

Troubleshooting Common Issues

Even with the right hardware and software, you might encounter issues. Here’s a troubleshooting guide to help resolve common problems:

- Card Reader Not Connecting:

- Bluetooth: Ensure Bluetooth is enabled on your mobile device. Check that the card reader is powered on and paired with your device. Unpair and re-pair the devices if necessary.

- Connection Type: If you use a reader that plugs into your device, check the connection port (audio jack, Lightning, or USB-C) for any obstructions or damage.

- Reader’s Battery: Make sure the card reader has sufficient battery power. Some readers have indicator lights to show the battery level.

- Unable to Process a Transaction:

- Internet Connection: Verify that your mobile device has a stable internet connection (Wi-Fi or mobile data). Try switching between Wi-Fi and mobile data to see if that resolves the issue.

- Card Reader Issues: Clean the card reader’s card slot. Try swiping or inserting the card again. If the issue persists, try a different card to rule out a card-specific problem.

- Payment Processor Issues: Check the payment processor’s website or social media for any service outages or known issues. Contact their customer support if necessary.

- Insufficient Funds/Card Issues: The issue could be with the customer’s card. Ask the customer to try another card or contact their bank.

- Software Errors:

- App Crashes: Close and reopen the payment processor app. Restart your mobile device.

- App Freezes: Force quit the app and clear the app’s cache. If the problem continues, consider uninstalling and reinstalling the app.

- Update Issues: If you have problems after an update, revert to the previous version of the app (if possible) or contact the payment processor’s support.

- Receipt Printing Problems:

- Printer Connection: Ensure the printer is connected to your mobile device via Bluetooth. Check that the printer is powered on and has paper.

- Printer Compatibility: Make sure the printer is compatible with the payment processor’s app. Check the app’s settings for printer configuration.

- Printer Driver: Ensure the printer driver is installed and up-to-date on your mobile device.

Accepting Payments

Now that you’ve set up your mobile payment system, the next step is actually accepting payments from your customers. This involves understanding the different methods available and how to execute them smoothly. Let’s delve into the practical procedures for processing transactions on the go.

Swiping or Tapping a Credit Card

Swiping or tapping a credit card is often the quickest and easiest way to process a payment. This method is familiar to most customers and is generally straightforward.To process a payment by swiping or tapping:

- Insert the Card Reader: Ensure the card reader is securely connected to your mobile device, either via the audio jack, Bluetooth, or another supported connection method.

- Open the Payment App: Launch the mobile payment processing app on your device.

- Enter the Transaction Amount: Input the total amount of the sale, including any applicable taxes or fees.

- Swipe or Tap the Card:

- Swiping: For cards with a magnetic stripe, instruct the customer to swipe their card through the card reader’s magnetic stripe reader.

- Tapping (NFC): For contactless payments (NFC), the customer should tap their card or mobile device (e.g., Apple Pay, Google Pay) on the card reader.

- Follow On-Screen Instructions: The app will guide you through the remaining steps, which may include asking the customer to sign on your device’s screen or entering their PIN.

- Process the Transaction: The app will then process the payment and provide confirmation.

- Provide a Receipt: Offer the customer a receipt, either digitally via email or text message, or printed if your system supports it.

Manually Entering Credit Card Information

Sometimes, you may need to manually enter credit card information. This might be necessary if the card is damaged, the card reader is malfunctioning, or if the customer is providing their card details over the phone.To manually enter credit card information:

- Open the Payment App: Launch the mobile payment processing app.

- Select Manual Entry: Look for an option to manually enter card details, usually labeled as “Manual Entry,” “Key In Card,” or similar.

- Enter Card Details: Carefully enter the following information, as prompted by the app:

- Card Number: The 16-digit (or longer) number on the front of the card.

- Expiration Date: The month and year the card expires.

- CVV/CVC Code: The three or four-digit security code, usually located on the back of the card.

- Cardholder’s Name: The name as it appears on the card.

- Billing Address: The cardholder’s billing address.

- Enter the Transaction Amount: Input the total amount of the sale.

- Process the Transaction: The app will process the payment. Be aware that manual entry transactions may sometimes be subject to higher processing fees or be flagged for additional security checks by the payment processor.

- Provide a Receipt: Offer the customer a receipt.

Handling Transactions with EMV Chip Cards and NFC Payments

EMV chip cards and NFC (Near Field Communication) payments have become increasingly common due to their enhanced security features. These methods offer a secure way to process transactions.To handle EMV chip cards and NFC payments:

- EMV Chip Cards:

- Insert the Card: The customer inserts their EMV chip card into the chip card reader slot on the card reader.

- Keep the Card Inserted: The customer should leave the card inserted until the transaction is complete, even if the app prompts them to remove it.

- Follow On-Screen Instructions: The app may prompt the customer to enter their PIN (Personal Identification Number) or sign on your device’s screen, depending on the card and the payment processor’s settings.

- NFC Payments (Contactless):

- Tap the Card or Device: The customer taps their contactless-enabled credit card or mobile device (e.g., Apple Pay, Google Pay, Samsung Pay) on the NFC reader of the card reader.

- Hold the Device Near the Reader: The customer should hold the card or device near the reader until the transaction is complete.

- Follow On-Screen Instructions: The app may require the customer to verify the payment with a PIN, fingerprint, or facial recognition, depending on the device and payment method.

- Transaction Confirmation: Once the transaction is successful, the app will provide confirmation, and you should provide the customer with a receipt.

Security Measures and Best Practices

Protecting your customers’ financial data and your business from fraud is paramount when accepting credit card payments on the go. Implementing robust security measures and adhering to best practices not only safeguards sensitive information but also builds trust with your customers, fostering a positive reputation for your business. This section Artikels key security considerations and provides actionable strategies to minimize risk.

End-to-End Encryption in Mobile Payment Processing

End-to-end encryption (E2EE) is a critical security measure in mobile payment processing, ensuring that sensitive cardholder data remains protected throughout the entire transaction process. This means that the data is encrypted from the moment it’s entered or swiped on the mobile device until it reaches the payment processor, and is decrypted only at the processor’s secure server.

- Data Protection: E2EE prevents unauthorized access to cardholder data by encrypting the information at the point of capture. This makes the data unreadable to anyone who intercepts it during transmission, including potential hackers or malicious actors.

- Compliance with PCI DSS: While not a direct substitute for PCI DSS compliance, E2EE significantly contributes to achieving it. It helps to reduce the scope of PCI DSS compliance by protecting cardholder data. This can streamline the compliance process.

- Tokenization: Many mobile payment processors utilize tokenization alongside E2EE. Tokenization replaces sensitive card data with a unique, randomly generated “token.” This token is then used for processing transactions, meaning that the actual card details are never stored or transmitted.

- Benefits for Businesses: By using E2EE, businesses can reduce the risk of data breaches, maintain customer trust, and avoid potential fines or legal issues associated with data compromises. It also provides a competitive advantage by demonstrating a commitment to data security.

Protecting Sensitive Customer Data

Safeguarding customer data involves a multi-layered approach, encompassing various security measures to prevent unauthorized access, theft, or misuse of sensitive information. This includes both physical and digital security protocols.

- Data Storage Minimization: Store only the minimum amount of customer data necessary to process transactions and fulfill legal requirements. The less data you store, the less vulnerable you are to data breaches.

- Secure Data Transmission: Always use secure communication protocols, such as HTTPS (Hypertext Transfer Protocol Secure), to encrypt data transmitted between your mobile device, the payment processor, and other systems.

- Regular Software Updates: Keep your mobile payment software, operating systems, and any related applications up-to-date with the latest security patches. Software updates often include fixes for vulnerabilities that could be exploited by hackers.

- Strong Passwords and Authentication: Implement strong passwords for all accounts and devices used for mobile payment processing. Consider using multi-factor authentication (MFA), which requires users to provide two or more verification factors to gain access. This could include a password and a code sent to their mobile device.

- Device Security: Protect your mobile devices with strong passwords, biometric authentication (such as fingerprint or facial recognition), and device encryption. Enable remote wipe capabilities in case a device is lost or stolen.

- Employee Training: Train your employees on data security best practices, including how to recognize and avoid phishing scams, social engineering attacks, and other threats. Educate them about the importance of protecting customer data and adhering to company security policies.

- Regular Security Audits: Conduct regular security audits and vulnerability assessments to identify and address any weaknesses in your security infrastructure. Consider hiring a third-party security firm to perform these audits.

- Data Breach Response Plan: Develop and maintain a comprehensive data breach response plan that Artikels the steps to take in the event of a security incident. This plan should include procedures for containing the breach, notifying affected customers, and coordinating with law enforcement and regulatory agencies.

Preventing Fraud and Chargebacks

Fraud and chargebacks can be costly and damaging to your business. Implementing proactive measures to prevent these issues is crucial for maintaining profitability and customer trust.

- Address Verification System (AVS) and Card Verification Value (CVV) Checks: Utilize AVS to verify the billing address provided by the customer against the address on file with the card issuer. Require the CVV (the three or four-digit security code on the back of the card) to be entered for all transactions.

- Transaction Monitoring: Implement transaction monitoring systems that can detect suspicious activity, such as unusually large transactions, multiple transactions from the same card within a short period, or transactions from high-risk countries.

- Geolocation Services: Use geolocation services to verify the customer’s location at the time of the transaction. This can help to identify potentially fraudulent transactions. For example, if a transaction is attempted from a location far from the customer’s usual spending patterns, it could raise a red flag.

- Velocity Limits: Set velocity limits, which restrict the number of transactions or the total dollar amount that can be processed within a specific timeframe. This can help to prevent fraudulent transactions from causing significant financial losses.

- Fraud Alerts and Notifications: Sign up for fraud alerts from your payment processor and credit card companies. These alerts will notify you of any suspicious activity on your account.

- Customer Verification: When possible, verify the customer’s identity before processing a transaction, especially for high-value purchases. This might involve asking for identification or verifying their phone number.

- Clear Refund and Return Policies: Establish clear and concise refund and return policies and communicate them to your customers. This can help to minimize disputes and chargebacks.

- Record Keeping: Maintain detailed records of all transactions, including customer information, transaction details, and any supporting documentation. This information is essential for resolving disputes and responding to chargebacks.

- Chargeback Management: Develop a process for managing chargebacks. Respond to chargebacks promptly and provide the necessary documentation to support your case.

- Educate Your Customers: Educate your customers about fraud prevention and encourage them to report any suspicious activity to their credit card companies.

Managing Transactions and Reporting

Keeping track of your financial activities is crucial for any business, especially when accepting payments on the go. Efficient transaction management and comprehensive reporting allow you to monitor sales, identify trends, and make informed decisions. This section provides a detailed guide on how to effectively manage transactions and generate insightful reports using your mobile payment processor.

Tracking Sales and Transaction History

Understanding how to navigate your payment processor’s app to view your sales history is essential for day-to-day operations. Most mobile payment processors offer robust features for tracking individual transactions and overall sales performance.

- Accessing Transaction Details: Typically, you can view individual transaction details by tapping on a specific transaction within the app. This will usually display information such as the date, time, amount, customer details (if collected), payment method, and any associated fees.

- Filtering and Sorting: The ability to filter and sort transactions is extremely useful. You can filter by date range, payment method (e.g., credit card, debit card), transaction status (e.g., completed, refunded), or even customer name. Sorting allows you to arrange transactions chronologically, by amount, or in other relevant ways.

- Search Functionality: A search function is generally available to locate specific transactions quickly. You can search by customer name, transaction ID, or the last four digits of the card used.

- Real-time Updates: Most processors provide real-time updates, meaning that as soon as a transaction is processed, it appears in your transaction history. This allows for immediate monitoring of sales.

Generating Reports for Sales, Refunds, and Financial Activities

Generating reports is vital for financial analysis and reconciliation. These reports provide a summarized view of your financial activities, helping you understand your business performance and identify areas for improvement.

- Types of Reports: Your mobile payment processor likely offers various report types, including:

- Sales Reports: Summarize total sales, broken down by date, payment method, and other relevant criteria.

- Refund Reports: Track all refunds processed, including the amount and the reason for the refund.

- Transaction Reports: Provide a detailed view of all transactions, including sales, refunds, and fees.

- Deposit Reports: Show the deposits made to your bank account, including the dates and amounts.

- Report Customization: Many processors allow you to customize reports to meet your specific needs. This might include setting date ranges, selecting the data to be displayed, and choosing the format for export (e.g., CSV, PDF).

- Report Exporting: The ability to export reports is crucial for record-keeping and integration with other accounting software. You can usually export reports to a spreadsheet format (like CSV) for further analysis or to share with your accountant.

- Understanding Report Data: Each report will include key metrics such as total sales, net sales (after fees), number of transactions, and average transaction value. Understanding these metrics is essential for analyzing your business performance. For example, if you notice a significant increase in refunds, it might indicate issues with product quality or customer service.

Reconciling Payments and Managing Financial Records

Reconciling payments involves comparing your transaction records with your bank statements to ensure accuracy. This process helps to identify and resolve any discrepancies.

- Reconciliation Steps:

- Gather Your Records: Collect your transaction reports from your mobile payment processor and your bank statements.

- Compare Transactions: Compare each transaction listed in your payment processor’s reports with the corresponding transactions on your bank statement.

- Identify Discrepancies: Look for any differences between the amounts, dates, or payment methods. These discrepancies might be due to processing errors, fees, or refunds.

- Investigate and Resolve: Investigate any discrepancies. This might involve contacting your payment processor or bank to resolve the issue.

- Document Everything: Keep detailed records of all transactions, reports, and any correspondence related to discrepancies.

- Record-Keeping Practices:

- Separate Business and Personal Finances: Maintain separate bank accounts for your business to simplify reconciliation and accounting.

- Use Accounting Software: Consider using accounting software (like QuickBooks, Xero, or Wave) to automate the reconciliation process and track your financial records. These platforms often integrate with mobile payment processors.

- Categorize Transactions: Categorize your transactions (e.g., sales, cost of goods sold, expenses) to gain a better understanding of your business’s financial performance.

- Regular Review: Review your financial records regularly (e.g., monthly or quarterly) to identify trends and make informed business decisions.

- Key Formulas and Calculations:

Net Sales = Gross Sales – Returns – Discounts

Profit = Revenue – Expenses

Understanding these basic formulas is critical for assessing the financial health of your business.

Handling Refunds and Disputes

Managing refunds and resolving disputes are crucial aspects of accepting credit card payments on the go. A well-defined process builds customer trust and protects your business from financial losses. Understanding how to handle these situations efficiently can significantly impact your business’s reputation and financial stability.

Issuing Refunds Through Your Mobile Payment System

Providing refunds is an essential part of customer service and a legal requirement in many jurisdictions. The process for issuing refunds is usually straightforward, but it’s important to understand the specific steps within your chosen mobile payment processor.* Most mobile payment processors offer a simple refund process accessible through their app or online dashboard.

- Typically, you will need to locate the original transaction within your transaction history.

- You will then select the option to issue a refund.

- The system will prompt you to enter the refund amount, which can be a full or partial refund.

- Confirm the refund to initiate the process. The funds will then be credited back to the customer’s credit card.

- Refund processing times can vary depending on the payment processor and the customer’s bank, but generally take a few business days to reflect in the customer’s account.

It’s crucial to have a clear refund policy in place and communicate it to your customers before the sale. This helps manage expectations and minimizes potential disputes. Your refund policy should Artikel the conditions under which refunds are offered, the timeframe for requesting a refund, and the method of refund. For example, a retail store might state: “We accept returns within 30 days of purchase with a receipt.

Refunds will be issued to the original form of payment.”

Responding to Customer Disputes and Chargebacks

Customer disputes and chargebacks are serious matters that can negatively affect your business. It’s important to understand the difference between a customer dispute and a chargeback and how to respond to each.* A customer dispute occurs when a customer contacts you directly to express dissatisfaction with a purchase. This might involve issues like a damaged product, a billing error, or a service not rendered.

The best approach is to address the customer’s concerns promptly and professionally. Try to resolve the issue directly with the customer. Offering a refund, exchange, or other compensation can often resolve the dispute and prevent it from escalating into a chargeback. A chargeback occurs when a customer disputes a transaction with their credit card issuer. The card issuer then investigates the transaction and, if they rule in favor of the customer, will reverse the payment and debit your account.

Chargebacks can result in fees, and excessive chargebacks can lead to the suspension of your payment processing account.When you receive a chargeback notification, you’ll need to gather and submit evidence to your payment processor to fight the chargeback. This evidence might include:* Proof of purchase (e.g., sales receipts).

- Delivery confirmation (if applicable).

- Customer communication.

- Terms and conditions of the sale.

The more detailed and organized your evidence, the better your chances of winning the chargeback.

Situations That May Lead to Chargebacks and How to Avoid Them

Certain situations are more likely to result in chargebacks. Understanding these situations and taking preventative measures can significantly reduce your chargeback rate.* Fraudulent Transactions: If a customer’s card is used without their authorization, a chargeback is likely. To avoid this: Verify the cardholder’s identity. For in-person transactions, compare the signature on the card with the signature on the receipt.

Use card-present transaction methods whenever possible, as they have lower chargeback risk.

If accepting payments over the phone or online, implement fraud prevention tools offered by your payment processor, such as address verification service (AVS) and card verification value (CVV) checks.

Non-Delivery of Goods or Services

If a customer doesn’t receive the product or service they paid for, they can file a chargeback. To avoid this:

Keep detailed records of all transactions, including dates, times, and descriptions of the goods or services provided.

Provide clear and accurate descriptions of your products or services.

If providing a service, ensure the customer is fully informed about what they are paying for.

Provide tracking information for shipped items.

Defective or Damaged Goods

If a customer receives a product that is defective or damaged, they may file a chargeback. To avoid this:

Inspect goods before shipping or delivering them.

Package goods securely to prevent damage during shipping.

Offer a clear and easy return/exchange policy.

Billing Errors

Errors in billing can lead to chargebacks. To avoid this:

Double-check all transaction amounts before processing.

Clearly display prices and fees.

Provide customers with receipts.

Customer Dissatisfaction

If a customer is unhappy with a purchase, they may file a chargeback. To avoid this:

Provide excellent customer service.

Address customer complaints promptly and professionally.

Offer refunds or exchanges when appropriate.

By implementing these strategies, you can minimize your chargeback risk and protect your business from financial losses.

Pricing and Fees

Understanding the cost structure of mobile payment processing is crucial for your business’s profitability. Fees can vary significantly between different providers, impacting your bottom line. This section breaks down the common fees and provides a comparison to help you make an informed decision.

Types of Fees

Payment processors employ various fee structures. Knowing these different fee types helps you understand where your money goes and how to minimize costs.

- Transaction Fees: This is the most common fee, charged for each successful transaction. It’s typically a percentage of the transaction amount, plus a small per-transaction fee. For example, a processor might charge 2.9% + $0.30 per transaction.

- Monthly Fees: Some processors charge a monthly fee for their services, regardless of the number of transactions processed. This fee might cover access to the payment gateway, reporting tools, and customer support.

- Hardware Fees: If you need a card reader, you’ll likely pay for the hardware. Some processors offer card readers for free, while others require a purchase or lease. Costs can range from a few dollars to several hundred, depending on the features and capabilities of the reader.

- Setup Fees: Some processors charge a one-time fee to set up your account. This fee can cover account activation and initial configuration.

- Chargeback Fees: When a customer disputes a transaction, a chargeback occurs. The processor may charge a fee to handle the chargeback, which can include investigating the dispute and providing evidence to defend the transaction.

- Other Fees: Other fees might include early termination fees (if you cancel your contract early), PCI compliance fees (to maintain security standards), and international transaction fees (for processing transactions from international cards).

Comparing Fee Structures

Payment processors use a variety of pricing models. Comparing these models is crucial to determining the most cost-effective option for your business.

- Flat-Rate Pricing: This model charges a fixed percentage and a per-transaction fee for all transactions. This is often the simplest model to understand. For example, a processor might charge 2.75% + $0.15 per transaction.

- Tiered Pricing: This model offers different rates based on the volume of transactions or the type of card used (e.g., debit cards vs. credit cards). Rates can vary depending on your business’s monthly processing volume.

- Interchange-Plus Pricing: This model is more transparent and typically used by larger businesses. It charges the interchange rate (the rate set by the card networks like Visa and Mastercard) plus a small percentage and a per-transaction fee.

Cost Comparison: $100 Transaction

The following table illustrates a hypothetical cost comparison for processing a $100 transaction across different payment processors. Please note that these are examples, and actual fees can vary based on your business type, transaction volume, and other factors. Always check the processor’s specific pricing details.

| Payment Processor | Transaction Fee | Monthly Fee | Cost of $100 Transaction |

|---|---|---|---|

| Processor A (Flat-Rate) | 2.75% + $0.15 | $0 | $2.90 |

| Processor B (Tiered) | 2.9% + $0.30 | $0 | $3.20 |

| Processor C (Interchange-Plus – Hypothetical) | Interchange Rate (1.5% – 2.0%) + 0.30% + $0.10 | $0 | $1.90 – $2.40 |

| Processor D (Flat-Rate, with monthly fee) | 2.6% + $0.10 | $25 | $2.70 (plus monthly fee, which needs to be amortized across transactions) |

Important Note: The “Cost of $100 Transaction” column represents the fees directly associated with that specific transaction. It doesn’t factor in any monthly fees, which would increase the effective cost per transaction if you process a low volume of sales. The Interchange-Plus example provides a range, reflecting the variability of the interchange rate.

Integrating with Other Business Tools

Integrating your mobile payment processing system with other business tools is crucial for streamlining your operations, saving time, and gaining valuable insights into your business performance. This integration allows data to flow seamlessly between your payment processor, accounting software, inventory management systems, and other platforms, providing a holistic view of your business activities.

Integrating with Accounting Software

Connecting your mobile payment system with your accounting software automates the reconciliation process, reducing manual data entry and minimizing errors. This integration ensures accurate financial records and provides a clear picture of your cash flow.Here’s how the integration typically works:

- Automatic Data Synchronization: Transactions processed through your mobile payment system are automatically synced with your accounting software. This includes sales, refunds, and fees.

- Categorization and Reconciliation: Transactions are categorized and matched with corresponding accounts in your accounting software, such as sales revenue, credit card fees, and sales tax. This simplifies reconciliation.

- Reporting and Analytics: The integrated system allows you to generate comprehensive financial reports, including sales summaries, profit and loss statements, and cash flow projections.

For example, consider a food truck business. Integrating its mobile payment system with accounting software like QuickBooks or Xero would automatically record each sale. At the end of the day, the owner can easily see the total sales, credit card fees, and net revenue, eliminating the need to manually enter each transaction. This saves time and ensures the accuracy of financial records.

Connecting with Inventory Management Systems

Integrating your mobile payment system with your inventory management system helps you track your stock levels in real-time, optimize your inventory, and avoid stockouts. This integration is particularly beneficial for businesses that sell physical goods.Here’s how this integration works:

- Real-time Inventory Updates: When a sale is processed, the inventory management system automatically deducts the sold items from your stock levels.

- Automated Reordering: The system can be configured to automatically trigger reordering when stock levels reach a predetermined threshold.

- Sales Data Analysis: Integration allows you to analyze sales data to identify fast-moving and slow-moving items, helping you make informed decisions about your inventory.

For instance, a mobile boutique uses a mobile payment system integrated with an inventory management system. When a customer purchases a dress, the system automatically updates the inventory count. The owner can then easily see how many of each dress size are left, and the system can alert them when it’s time to reorder. This ensures they always have the right products available for their customers.

Demonstrating the Process of Integrating with Other Business Tools to Streamline Operations

Integrating with other business tools streamlines operations by automating tasks, reducing manual effort, and improving data accuracy. This allows you to focus on growing your business rather than on administrative tasks.Here are some specific examples of how integration streamlines operations:

- Reduced Manual Data Entry: Automation minimizes the need to manually enter data into different systems, reducing the risk of errors and saving time.

- Improved Data Accuracy: Data is automatically synced between systems, ensuring that your records are always up-to-date and accurate.

- Faster Reporting and Analytics: Integrated systems provide real-time access to data, allowing you to generate reports and analyze performance quickly.

- Enhanced Customer Experience: By streamlining operations, you can provide faster and more efficient service to your customers.

- Better Inventory Management: Real-time inventory updates help you avoid stockouts and overstocking, optimizing your inventory levels.

Consider a mobile coffee shop. Integrating its payment system with its accounting software and inventory management system would provide several benefits. Sales data would automatically sync with the accounting software, simplifying financial reporting. The inventory system would track coffee beans, milk, and other supplies, automatically updating stock levels with each sale. This would help the owner manage inventory efficiently, minimize waste, and ensure they always have enough supplies on hand to serve their customers.

This integrated approach allows the owner to focus on providing excellent coffee and customer service.

Troubleshooting Common Issues

Accepting mobile credit card payments is generally smooth, but occasionally, you might encounter issues. This section helps you diagnose and resolve common problems, ensuring your mobile payment system functions reliably and efficiently. We’ll cover connectivity problems, card reader glitches, and app-related issues, providing practical solutions to keep your business running smoothly.

Connectivity Problems

Connectivity issues are a frequent hurdle when processing mobile payments. A stable internet connection is critical for transactions to go through. Several factors can disrupt connectivity, leading to payment failures.To address connectivity problems, consider the following:

- Check Your Internet Connection: Ensure you have a strong and stable internet connection. Test your Wi-Fi signal strength or your cellular data signal. If using Wi-Fi, move closer to the router. For cellular data, check the signal bars on your device.

- Troubleshoot Wi-Fi: If using Wi-Fi, try restarting your router. Sometimes, a simple reset can resolve connectivity issues. If the problem persists, check your router’s configuration to ensure it’s not blocking payment processing traffic.

- Switch Between Networks: If one network is unreliable, switch between Wi-Fi and cellular data. This can help determine if the problem lies with a specific network.

- Airplane Mode: Toggle airplane mode on and off. This resets your device’s network connections, which can sometimes resolve connectivity glitches.

- Data Usage: Ensure you haven’t exceeded your data plan limits. Check your data usage settings to see if your payment processing app is consuming excessive data.

- Firewall/Security Settings: Check your device’s firewall or security settings. Sometimes, these settings can block payment processing apps from accessing the internet. Adjust your settings to allow the app to function correctly.

Card Reader and Payment Processing App Issues

Problems with your card reader or payment processing app can also halt transactions. These issues range from hardware malfunctions to software glitches. Addressing these problems quickly minimizes disruption.To resolve card reader and payment processing app issues, consider these steps:

- Card Reader Troubleshooting:

- Check the Connection: Ensure the card reader is properly connected to your device via Bluetooth or the audio jack, depending on the model. Disconnect and reconnect the reader to ensure a secure connection.

- Battery Life: Verify that your card reader has sufficient battery life. Low battery can cause malfunctions. Charge the reader fully before use.

- Cleaning: Clean the card reader’s card slot and chip reader. Dust and debris can interfere with card reading. Use a soft, dry cloth.

- Restart the Reader: Try restarting the card reader. Most readers have a power button or a reset function. This can often resolve temporary glitches.

- Update Firmware: Ensure your card reader’s firmware is up to date. Check the payment processor’s app for firmware updates.

- Payment Processing App Troubleshooting:

- App Updates: Ensure you’re using the latest version of the payment processing app. Updates often include bug fixes and performance improvements. Check the app store for updates.

- Restart the App: Close and restart the payment processing app. This can clear temporary errors.

- Clear Cache: Clear the app’s cache. Excessive cached data can sometimes cause performance issues. Check your device’s settings for the app and clear the cache.

- Reinstall the App: If problems persist, try uninstalling and reinstalling the app. This can resolve more persistent software issues.

- Check for Server Outages: Occasionally, the payment processor’s servers might experience outages. Check the payment processor’s website or social media for announcements about service disruptions.

Resolving Common Error Messages

Error messages can provide valuable clues about the problem. Understanding these messages can help you quickly identify and resolve issues.Common error messages and their solutions include:

- “Connection Error”: This usually indicates a problem with your internet connection. Check your Wi-Fi or cellular data signal. Try switching between networks.

- “Card Read Error”: This suggests a problem with the card reader or the card itself. Clean the card reader’s card slot. Try inserting the card again. If the problem persists, try a different card.

- “Transaction Declined”: This message could be due to insufficient funds, an expired card, or a problem with the card issuer. Ask the customer to check their card details or try another payment method.

- “Processing Error”: This may be due to an issue with the payment processor’s servers or the app. Check the payment processor’s status page for any reported outages. Restart the app.

- “Invalid Card Number”: Double-check that the card number was entered correctly if manually input. If using a card reader, ensure the card is swiped or inserted correctly.

Marketing and Promoting Mobile Payment Acceptance

Effectively marketing your mobile payment acceptance capabilities is crucial for driving customer adoption and boosting sales. This section provides strategies to inform your customers, highlight the convenience of mobile payments, and offer promotional materials you can adapt for your business.

Informing Customers About Mobile Payment Options

Letting your customers know you accept mobile payments is the first step in encouraging them to use this convenient method. Clear and consistent communication across various channels is key.

- In-Store Signage: Place visible signs near your point-of-sale (POS) system. These signs should clearly display the accepted mobile payment methods (e.g., Apple Pay, Google Pay, Samsung Pay). Make sure the signs are easily readable and attract attention. Consider using colorful graphics and icons to make them more appealing.

- Website and Social Media: Update your website and social media profiles to indicate that you accept mobile payments. Create posts highlighting the benefits of mobile payments, such as speed and security. Use relevant hashtags (e.g., #mobilepayments, #applepay, #googlepay) to increase visibility.

- Email Marketing: Include a note about mobile payment acceptance in your email newsletters and promotional emails. This is a great way to inform your existing customer base. Offer exclusive discounts or promotions for customers who pay with mobile devices to incentivize adoption.

- Receipts: Print a message on your customer receipts stating that you accept mobile payments. This serves as a subtle reminder at the point of transaction.

- Staff Training: Ensure your staff is well-trained and can confidently inform customers about mobile payment options. They should be able to answer any questions and guide customers through the process. Provide them with talking points and visual aids.

Marketing the Convenience of Mobile Payments

Emphasizing the convenience of mobile payments is essential to attract customers. Highlight the speed, security, and ease of use.

- Speed and Efficiency: Mobile payments are typically faster than traditional card payments, saving customers time. Emphasize the speed by comparing the time it takes to tap a phone or watch versus inserting or swiping a card.

- Enhanced Security: Mobile payments often use tokenization and encryption, making them more secure than traditional card payments. Promote the security features, such as biometric authentication (fingerprint or facial recognition) and the fact that the actual card details are never shared with the merchant.

- Contactless Experience: Promote the contactless aspect, especially in the current environment. Highlight the ability to avoid touching payment terminals.

- Integration with Loyalty Programs: If your mobile payment system integrates with loyalty programs, emphasize this feature. Customers can earn rewards and benefits with every purchase.

- Offer Promotions: Offer promotions specifically for mobile payment users. For example, offer a discount on their first mobile payment, or a bonus reward points.

Promotional Material for Businesses

Create promotional material that businesses can use to showcase their mobile payment acceptance. Adapt these templates to your specific brand and offerings.

Headline: Pay the Easy Way: Now Accepting Mobile Payments!

Body: We’re excited to offer you a faster, safer, and more convenient way to pay! Now accepting Apple Pay, Google Pay, and Samsung Pay.

Benefits:

- Fast and Easy: Tap and go!

- Secure: Your card details are protected.

- Contactless: Safe and hygienic.

Call to Action: Ask us how to pay with your phone today!

- Social Media Graphics: Create visually appealing graphics for social media posts. These could include images of phones tapping payment terminals, logos of accepted payment methods, and clear messaging about the benefits.

- Printable Flyers and Posters: Design flyers and posters to display in your store. Include the same key information as the social media graphics, ensuring it is easily readable.

- Email Templates: Develop email templates that businesses can customize and send to their customers. The templates should include an introduction, a description of the benefits of mobile payments, and a call to action.

- Example: A coffee shop could create a poster stating “Skip the Line, Pay with Your Phone! Enjoy a free pastry with your first mobile payment.”

Future Trends in Mobile Payment Processing

The mobile payment landscape is constantly evolving, driven by technological advancements and changing consumer preferences. Understanding these emerging trends is crucial for small businesses to stay competitive and leverage new opportunities. Embracing these innovations can lead to increased efficiency, improved customer experiences, and ultimately, greater profitability.

Biometric Authentication in Mobile Payments

Biometric authentication is rapidly becoming a standard feature in mobile payments, enhancing security and convenience. Technologies like fingerprint scanning, facial recognition, and voice authentication are replacing traditional passwords and PINs.

- Enhanced Security: Biometric data is unique to each individual, making it significantly more difficult for fraudsters to gain unauthorized access to payment information. For example, a fingerprint scan requires physical presence and eliminates the risk of password theft or guessing.

- Increased Convenience: Users can authenticate transactions quickly and easily, streamlining the checkout process. Instead of entering a long password or PIN, a simple touch or glance is sufficient.

- Improved User Experience: Biometric authentication offers a seamless and intuitive payment experience. This is especially beneficial for businesses aiming to provide a frictionless and customer-friendly environment.

Contactless Payments and Near Field Communication (NFC)

Contactless payments, facilitated by NFC technology, are gaining widespread adoption, particularly in physical retail environments. Consumers can simply tap their smartphones or payment cards on a point-of-sale (POS) terminal to complete a transaction.

- Speed and Efficiency: Contactless payments are significantly faster than traditional card payments, reducing checkout times and improving customer flow.

- Reduced Physical Contact: In the wake of health concerns, contactless payments offer a hygienic alternative to cash and card transactions, minimizing the need for physical contact with payment terminals.

- Integration with Mobile Wallets: NFC technology is a core component of mobile wallets like Apple Pay and Google Pay, enabling users to store multiple payment methods on their smartphones and use them for contactless payments.

The Rise of QR Code Payments

QR codes provide a versatile and cost-effective method for accepting mobile payments, particularly for small businesses and those operating in developing markets.

- Ease of Implementation: QR code payment systems are relatively simple to set up and require minimal hardware. Businesses can generate QR codes for specific products or services, which customers can scan with their smartphones to initiate payments.

- Cost-Effectiveness: QR code payments often have lower transaction fees compared to traditional card processing. This can translate to significant cost savings for small businesses.

- Versatility: QR codes can be used in various settings, including physical stores, online platforms, and even invoices. This adaptability makes them a valuable tool for businesses with diverse payment needs.

Mobile Wallets and Digital Currencies

Mobile wallets continue to evolve, integrating with various services and offering new functionalities. Digital currencies are also gaining traction as an alternative payment method.

- Increased Functionality: Mobile wallets are expanding beyond payment processing to include features like loyalty programs, rewards, and budgeting tools. This enhances their appeal to consumers and fosters customer loyalty.

- Integration with Loyalty Programs: Businesses can integrate their loyalty programs with mobile wallets, allowing customers to earn and redeem rewards seamlessly. This can boost customer engagement and encourage repeat purchases.

- Potential for Digital Currencies: The adoption of digital currencies, such as Bitcoin and Ethereum, could offer new payment options and opportunities for businesses. While the regulatory landscape for digital currencies is still evolving, their potential impact on the mobile payment landscape is significant.

The Impact on Small Businesses

These trends have the potential to significantly impact small businesses, offering both opportunities and challenges.

- Increased Efficiency: Streamlined payment processes, such as contactless payments and mobile wallets, can reduce checkout times and improve operational efficiency.

- Enhanced Customer Experience: Offering convenient and secure payment options can enhance the customer experience and drive customer loyalty.

- Cost Savings: Implementing cost-effective payment solutions, such as QR code payments, can help small businesses reduce transaction fees.

- Adaptability and Innovation: Small businesses that embrace these trends can stay competitive and adapt to the evolving payment landscape. This requires a proactive approach to technology adoption and a willingness to experiment with new payment solutions.

End of Discussion

From choosing the right processor to mastering security protocols, this guide has equipped you with the knowledge to seamlessly accept credit card payments on the go. Embrace the flexibility and convenience of mobile payments, and watch your business thrive. By staying informed about emerging trends and best practices, you can ensure your payment system remains secure, efficient, and ready to meet the evolving needs of your customers.